Businesses should evaluate their strategic purpose if there's no clear path to market leadership, they should consider liquidation, sale, or repurposing.

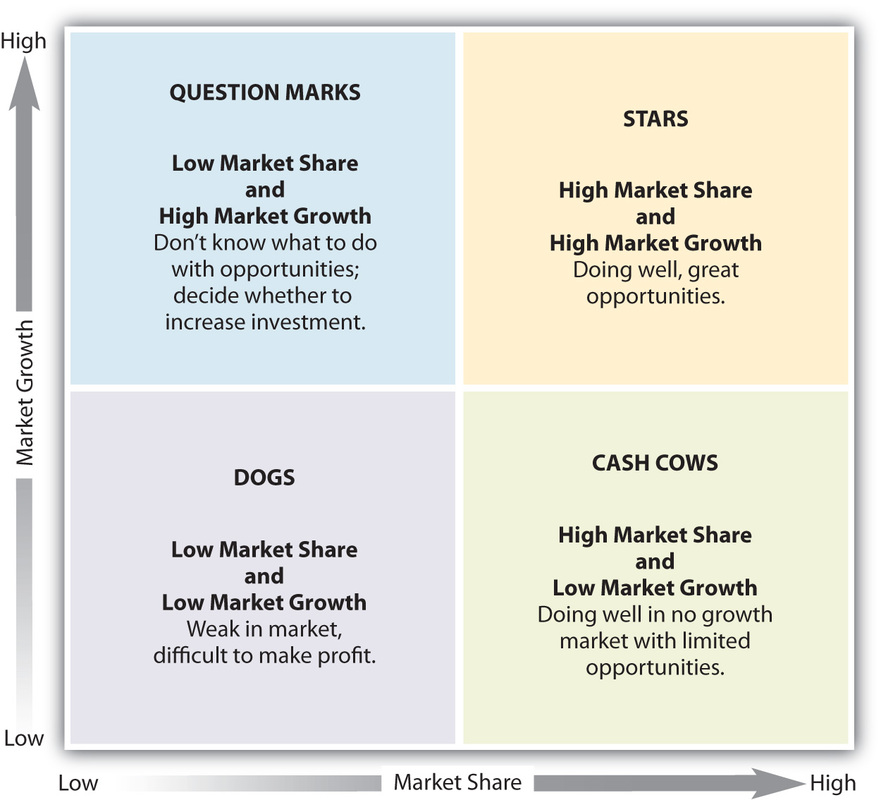

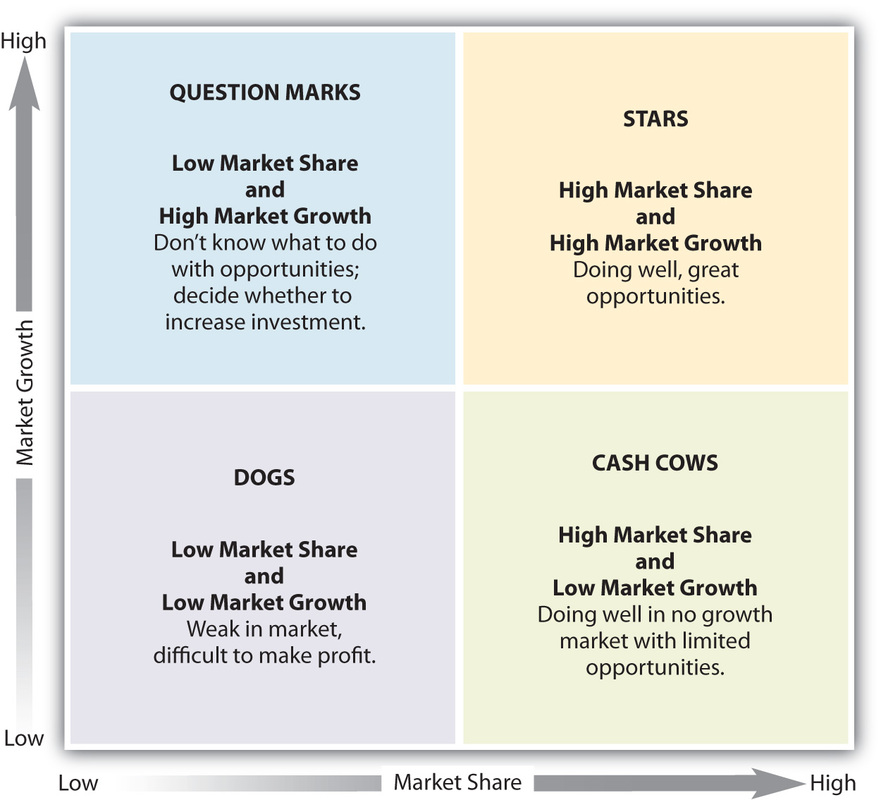

Dogs (Low Share and Low Growth Rate): These are the products with low market share in slow-growth industries. Question Marks (Low Share and High Growth Rate): Depending on their potential to become stars, businesses should either invest in them to enhance market share or consider phasing them out. Stars (High Share and High Growth Rate): Because of their significant future potential, businesses should heavily invest in these "stars" as they have the potential of becoming a cash cow. Cash Cows (High Share and Low Growth Rate): Businesses should extract the cash from these "cash cows" to reinvest in other areas or quadrants. The matrix divides the product or the business unit into four equal quadrants that reflects a certain mix of growth and market share as compared to the other quadrants: These factors are primarily influenced by a company's relative market share and the growth rate of the markets in which it operates. The BCG Matrix is a valuable tool for strategic planning that helps businesses determine where to allocate their resources based on two critical factors: firm competitiveness and market attractiveness. The relevance of the growth-share matrix has evolved, and now, it has to be implemented more swiftly and with a greater emphasis on strategic experimentation to allow adaptation to a more volatile corporate environment. The matrix is not a prediction tool but a tool for making decisions and, thus, may not always account for all the variables that a company will eventually have to deal with. The matrix displays two aspects that firms should take into account when determining where to invest: Firm competitiveness and Market attractiveness.

Cash cows: High Market Share, Low Growth.Question marks: Low Market Share, High Growth.Each quadrant has a different symbol that denotes a different level of profitability depending on the market share and growth:

The BCG matrix assigns a two-by-two matrix classification to a company's goods and/or services.It is also known as the product portfolio matrix. The BCG Growth-Share Matrix is a business planning tool used to assess the strategic position of a company's brand portfolio.

0 kommentar(er)

0 kommentar(er)